fossils are out, lower-carbon fuels are in

ringing in 2024, conferring with fossil fuel peeps, and environmental markets!

Happy New Year, friends! How have your first two weeks of 2024 been? Good? Ok, good. Mine have been a whirlwind. I spent the week at a carbon markets and lower carbon fuels standard (LCFS) conference in San Diego. It was awesome. Let me tell you why and what I learned.😊

I’ve been to many conferences over the years. This was not like the others.

I attended my first, ClimateCon, as a freshman in high school. I attended a couple climate conferences in 2015 that have shaped the course of my life. I’ve emailed one of ClimateCon’s keynote speakers,

, letting him know. Tom’s work and writing on climate, from Waking the Frog to Climate Capitalism, and now to It’s Getting Hot in Here, has significantly influenced my theory of change. If you see happen to see this, hi Tom! Thanks for your latest response re: biochar production. Also, I’d love to visit your farm in Quebec some day.From Climate Reality to the Ontario Nature Youth Summit for Environmental Leadership to more industry-focused MIT Energy Conference and HBS Energy and Environment Symposium, I’ve been to many conferences surrounded by climate-focused peers over the years.

This was the first conference I attended where traditional energy professionals outnumbered environmental/climate-first professionals.

meeting the fossil fuel industry 🤝

I love meeting new people. I love meeting people who challenge my way of thinking.

For full transparency - and I’m a little embarrassed to share this as it has been a month since I signed up for this conference - I did not know what OPIS stood for. I googled OPIS as I am writing this.

OPIS stands for OIL PRICE INFORMATION SERVICE. Hah. The reality is, the energy transition means we need to work with the energy industry, which is dominated by fossil fuels, and move towards lower-carbon sources of energy.

Oil Price Information Service (OPIS) provides price transparency across the global supply chain so that all stakeholders can buy and sell oil and energy commodities with confidence. We do this by providing transparent pricing, real-time news, powerful analytics and software and educational and networking events.

So it really shouldn’t come as a surprise that there were so many oil and gas refiners to commodities traders in the room.

I actually ran into a friend from college who now works at a hedge fund and has spent the last year focused on carbon. I also had lunch with Joe*, the President of a Oil Refining company. He knew some of the carbon markets folks who were in the oil industry before making the switch to carbon management.

Refining refers to transforming raw material into a product. Refining crude oil, the raw hydrocarbons underground in liquid phase, can include processing into the gas we use in our cars. In any case, there was a vibrant exchange of ideas and new friends were made.

fossils are out, fuels are still in

A quote from a fossil fuel vet, in the context of transportation fuel: “no one is talking about fossils anymore”. Yeah. I have my otter.ai transcription if you want the receipts.

While we need to electrify almost everything, fuels will continue to be an important energy carrier and necessary in the near future. Much of our infrastructure is designed to be powered by liquid fuels. That said, we have pathways to low-carbon fuels. These pathways were a focus of this conference, and policies like LCFS which mandate them have been wildly successful. In fact, LCFS has worked so well that there has been an unprecedented number of credits generated.

After conversations with 8+ Shell and Chevron employees, who were all very kind and chill people, it was clear that people are doing a job and many found their work quite interesting. When I asked about climate targets, they acknowledged an overall trend towards renewable fuels. From a lady at Shell San Diego: “we all know we are moving towards renewables” - at least on the fuels side.

I do not think what these companies are doing are chill, but individuals working at these companies are people that we should have healthy dialogue with. I am by nature a non-confrontational person. I believe that when approaching topics with clearly diverging opinions, we should have an open mind. Sometimes, I wish I were more hard-headed, but I’m working to find an “effective” and friendly voice.

re-learning the language of environmental markets

Cap and trade works to set a firm ceiling on ghg emissions. Using ~market mechanisms~ entities can achieve emission-reduction goals most cost-effectively. Every entity has to use one allowance, a permit to emit, for each ton of GHG emissions. Covered entities will be given allowed and can buy additional allowances either at an auction or form other entities, or purchase offset credits. LCFS differs from cap and trade, but it is a helpful foundation to build off of.

lower. carbon. fuel. standard. it’s in the name

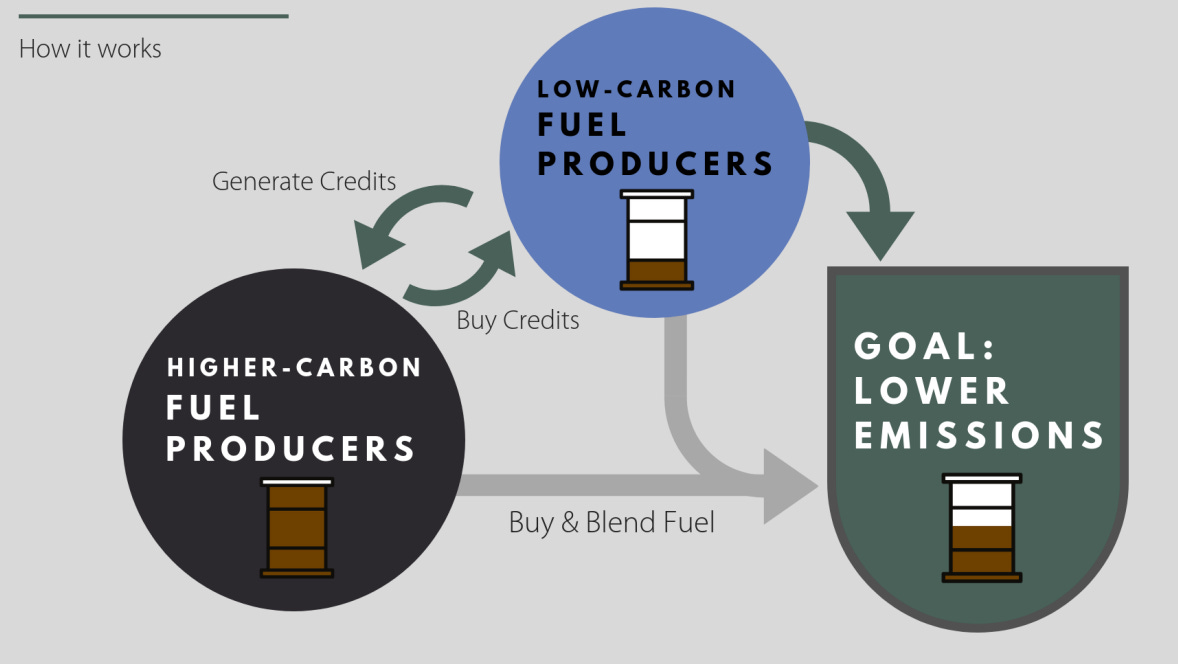

So what even is LCFS? Under the lower carbon fuel standard, entities (aka, fuel producers and importers) have to meet a level of carbon intensity for their product. Carbon intensity (CI) refers to how many CO2 emissions are released per unit of activity. In this case, CI is in grams of CO2 per megajoule of energy.

lcfs = tighter carbon intensity targets = healthier planet

Or something like that, it’s been a while since I’ve done hard math. But it really isn’t that deep. Joe, the oil exec I mentioned earlier, broke down how deficits and credits are created under LCFS. Fuels above or below the ghg target will generate deficits or credits. Producers of fuels can buy credits to meet an annual target. The target will become progressively more stringent. Good, because we are in a climate crisis people!

At the end of the day, LCFS and similar clean fuel standards will:

provide certainty for ghg reductions

allow markets to find cost-effective solutions

improve air quality and public health

Oh, in case you were wondering why all this is relevant for a product strategy person at a technology company, keeping a pulse on broader market and policy changes is important. Antora, the energy storage company I work at, is focused on decarbonizing industrial heat. Turns out, producing fuel takes a lot of energy and heat! So we are out here decarbonizing the fuel that is decarbonizing transport. 🧠

I learned a lot. One of the rare occasions where what you learn in school really comes in clutch, my environmental economics class has been incredibly relevant to work as of late. I’m not going to lie, seeing my environmental economics professor’s ideas, alongside the work of many others, have come to influence the markets that underpin our economy. From transportation to industry, we rely on fuel to move us around.

Here is a bit more about the conference from the website:

Jurisdictional cap-and-trade programs continue to gain steam in North America, with Washington’s new Cap-and-Invest program bursting out of the gate in its much-anticipated debut while New York gears up for the launch of its own program, one that faces unique challenges, especially considering the state’s existing participation in the Regional Greenhouse Gas Initiative.

California and Quebec’s landmark joint Cap-and-Trade program is undergoing regulatory review by state lawmakers considering adjustments that could have a significant impact on allowance supply and demand fundamentals.

Meanwhile, the global voluntary carbon market is facing a potential watershed moment, continuing to seek avenues to scale while also facing serious questions about credit quality and the growing scrutiny of the asserted benefits provided by the projects that supply them.

Low Carbon Fuel Standard (LCFS) programs are under the microscope, perhaps now more than ever before. California’s LCFS is nearing the end of what has been an exceptionally lengthy rulemaking process to extend the targets out to 2045, as well as possibly raise the nearer-term targets to 2030. As the market continues to churn out low-carbon fuels far ahead of the current compliance schedule, the situation is becoming increasingly dire for producers of the fuels as they nervously await CARB’s final revisions

day 1: carbon markets

I first dove into compliance and voluntary carbon markets in 2021. It’s been a little over 3 years now, and what a ride it’s been watching the industry evolve. And by ride, I mean it’s been a bit of a rollercoaster, but one you just don’t want to get off of.

I’ll probably update this post with additional thoughts But this is me trying to write more off the cuff and sound more like me. Shoutout to Amy and Mel for being real. <3

Oh, and if you liked this, please share with a friend! Maybe two if you’re feeling generous, but that’s twice as many lot of buttons to tap.

Thanks for reading! Hope you have a great week. Oh, I also played lots of volleyball in SD. Mission beach had rows on rows of volleyball courts. Enjoy this photo for good vibes:

Read more:

OPIS (now that we all know what that stands for). Conference agenda with speakers/orgs whose works you can learn more about. If you want to learn more about any of the workshops, HMU.

E-mission Control. What’s the difference between LCFS and cap-and-trade?

California Air Resources Board. CARB. LCFS Pathway Certified Carbon Intensities.

(we love CARB!)