the climate capital stack

what the FOAK is FOAK? learnings from Antora on funding climate tech projects and infrastructure for decarbonization

“Deploy, deploy, deploy” is our new mantra in decarbonizing the global economy. With abundant technologies, barriers to advancing climate solutions involve project deployment and execution: permitting, siting, interconnection, legal and finance structuring, and construction. At Antora Energy, we are deploying our technology to provide industry with zero carbon heat and power. As Antora has been scaling, I’ve been thinking more about the financing needed to deploy climate infrastructure. FOAK project financing is a key priority to enable our company to hit our next milestone. In fact, the amount of capital needed for individual projects is on the scale of our company’s entire Series B round of $150M. Join me in my journey as I learn about FOAK climate infra projects with a beginner’s mind.

What the FOAK is FOAK?

FOAK refers to first-of-a-kind projects. Think grinding mills for enhanced rock weathering, sustainable cement plants, or, my favorite, thermal energy storage to electrify industrial heat. They’re first of a kind because there’s no past project to copy and paste from. The novelty can arise from the technology, the business model, the application, or the geography, among others.

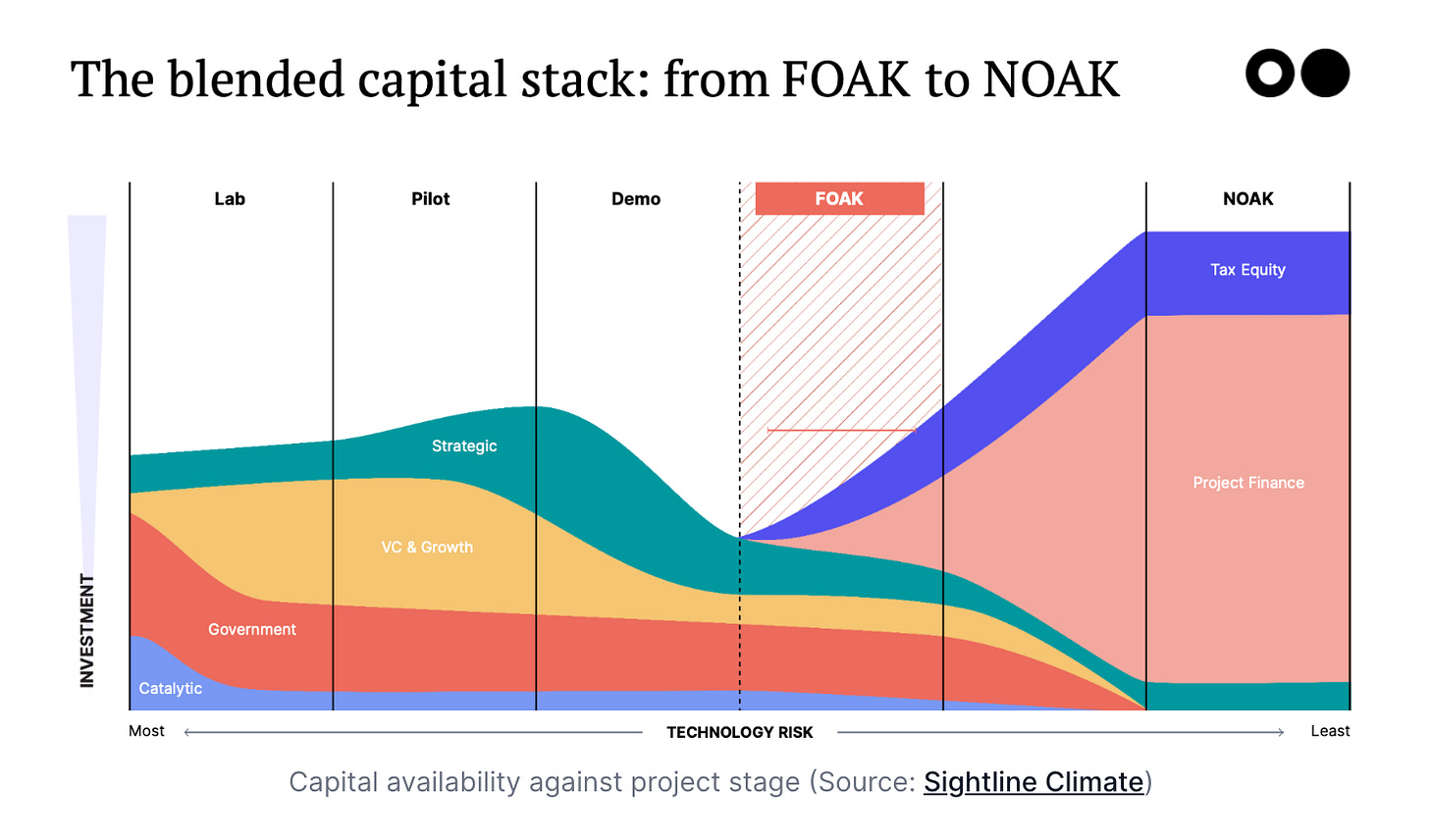

FOAK projects are notoriously difficult to finance. FOAK projects don’t offer return profiles high enough for VC firms, but are too risky for commercial infrastructure and debt investors. To scale the tech we desperately need for grid decarbonization–whether long-duration storage, nuclear, or hydrogen–we need to figure out how to pay to put steel in the ground. Deploying emerging hardtech is capital-intensive, which necessitates a diverse climate capital stack.

Enter the Climate Capital Stack

A diverse set of capital providers will fund the energy transition. The climate capital stack includes a blend of VC and infra expertise, as well as philanthropic capital, grant funders, customers, and strategics. Financial backers of clean energy projects have traditionally involved venture capital, private equity, hedge funds, pension funds, and sovereign wealth funds.

Let’s walk through each type of capital and who might provide it.

Catalytic refers to risk-tolerant, patient, and flexible capital. Catalytic capital is less concerned with financial returns and more focused on long-term impact. (e.g. Prime Impact Fund, where I interned in 2021!)

VC and Growth refers to venture capital in early stage companies (e.g. Breakthrough Energy Ventures) and growth equity funds (e.g. Blackrock and Temasek's Decarbonization Partners) who invest or acquire controlling stakes in growth-stage tech companies. They mostly take equity.

Strategics are corporate investors with industry expertise and aligned incentives, such as using the startup’s solution themselves. (e.g. BHP, Schneider Electric)

Government refers to non-dilutive government grants and loans (ie. DOE–the Loan Programs Office is the 🐐).

Tax equity involves monetizing tax credits to offset the company/taxpayer’s tax liability. (e.g. Inflation Reduction Act’s tax provisions, also 🐐’d)

Project finance, is a blend of equity (20-30%) and debt (70-80%). (e.g. Generate Capital).

Where my risk tolerant infrastructure investors at?

Crucially, there is a gap of funding after the demonstration stage of climate tech. This valley has been coined the “missing middle”. Growth and private equity investors invest in companies. However, equity is considered expensive capital. As climate tech startups scale, infrastructure focused project finance will be necessary as project debt is a cheaper form of capital. Traditional infra finance is still not accessible for less-proven climate technologies. Hybrid infrastructure investors have mixed equity and asset financing for early projects (ie. SpringLane Capital).

Antora’s adolescence

We’ve made it out of the lab and have successfully piloted! Now in our Series B as a scaling hardtech company, Antora is growing out of its infancy into its adolescence. We’re entering the awkward valley of FOAK. From our new technology to applications in traditional industries, much of our work is first-of-a-kind. Antora soaks up excess wind and solar to provide zero-carbon heat for industrial applications, at costs competitive with natural gas. We are taking on industrial gas boilers that have been used for centuries. Even the ways we’re procuring clean power to charge our batteries requires FOAK contracts and financing structures.

For much of Antora’s life as a company, our funding has come from grants and private investors. VC investors include Breakthrough Energy Ventures and LowerCarbon Capital, and more recently strategic investors such as BHP. Government funding through ARPA-E helped kickstart our company. While previous rounds have been used to de-risk our technology, the next phase of our company involves commercial projects–this requires project finance as opposed to VC.

It might sound meta, but money costs money. The cost of capital reflects the risk the financier takes on. Each dimension of novelty in FOAK projects adds risk, and the riskier, the higher the cost of capital. (CTVC) Raising $50M in equity may cost more than $50M in debt in the long run, because equity demands a higher rate of return. Equity investors take on more risk because they get paid after debt holders, and their returns are not guaranteed. Therefore, they usually expect higher returns to compensate for this increased risk.

Project Finance 101

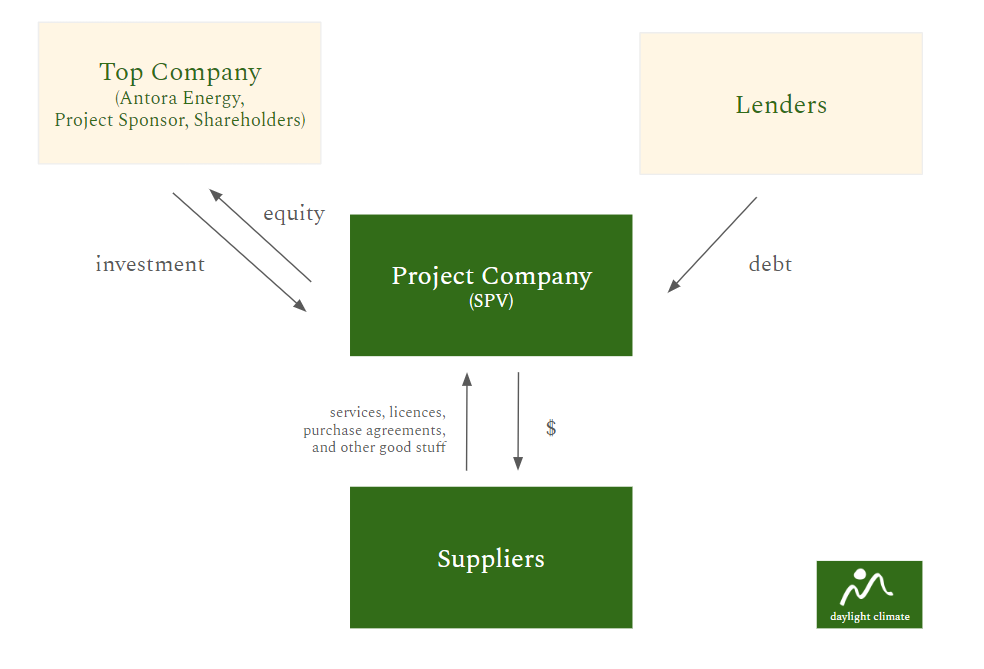

Project finance is a way to raise long-term debt financing for large projects, lending against cash flow generated by the projects. Project finance is used to finance large projects that are legally and financially “independent”. That is, a whole new project company is set up known as the “special purpose vehicle” or SPV. The project sponsor is the big energy company looking to do the project. It could be a wind developer building a new wind farm. The established company has an established company with assets, liabilities, and equity on its balance sheet. By setting up a separate entity for the project, the project sponsor can protect its assets.

To raise project finance, Antora pitches to project financiers and undergoes a diligence process similar to raising a venture round. Our project pitch deck lays out everything from utility supply to EPC–engineering, procurement, construction–agreements. We sign offtake contracts, like PPAs, with customers to purchase our low-carbon steam and energy over the 20-30 years. We need to show our offtake customers are credit worthy and will have continued business. Afterall, if they go out of business, they won’t be able to keep buying our energy.

The risk tolerance between project financiers and venture capital investors is stark. The typical internal rate of return for a project is 12-16%. Not bad! But venture investors are a different breed. VC scale returns mean a 30% gross internal rate of return on successful investments. The capital availability at each project stage reflects the risk appetite and incentives of the funders.

Figure out FOAK to scale climate infrastructure

To deploy the capital-intensive climate tech, we’ll need to figure out FOAK. While software can survive on solely VC funding, hardtech and infrastructure cannot. Despite the challenges, industrial-scale climate tech is moving forward. Contracts are being signed, steel is being put in the ground. Come join me at Antora and make it happen faster :)

A huge thanks to Jamie for thoughtful edits. You are awesome!

Learn more

Creds to the CTVC team and David Yeh, a climate infra OG. Check out their four part series on FOAK:

I. Venture to Project Finance Duolingo

E.R. Yescombe. Principles of Project Finance. (my leisurely CalTrain read)

Dave Margulius. Climate-Related Business Concepts, Explained.

Grace Donnelly. CTVC. The bridge to bankability is still under construction.

Kimble McCraw. ThirdWay. Energy Finance 101: What is Project Finance?

Rob Day. Where Are The “First-Of-A-Kind” Investors For Climate Solutions?

S2G Ventures. The Missing Middle: Capital Imbalances in the Energy Transition.

Happy Earth Day and SF Climate Week! Join the subscriber chat to exchange notes on which events to attend. Hope you have a great week!