The Climate Capital Stack: Scaling Solutions with Project Finance

why VC just won't cut it when it comes to scaling climate infrastructure

Solar and wind were emerging technologies just 15 years ago, yet their costs have plummeted dramatically - with solar prices falling by 90% and wind by 70% in the last decade alone. How can we replicate their cost downs for emerging climate technologies like heat batteries? It turns out, through innovative financing.

If you’re in climatetech, it’s not enough to only understand early-stage VC funding anymore. When I joined Antora Energy, a startup building large-scale heat batteries, I had very little knowledge of project finance. I had worked in early stage climate VC and startups. However, it will take a lot more than VC to scale the decarb solutions we desperately need. I’d soon learn this as we worked to put projects in front of new financiers. This is the energy project finance and climate capital stack briefer I wish I had in 2023 when I joined Antora’s commercialization team.

Whether you’re an investor, founder, or operator, or if you simply want to learn how to scale the climate technologies we have today, I this guide serves as a helpful trailhead.

While venture capital may have jumpstarted tech development, infrastructure equity and project finance debt is what will scale them. We have the technologies we need to solve climate change. It's time to deploy and scale them. However, climate infrastructure can be incredibly capital intensive.

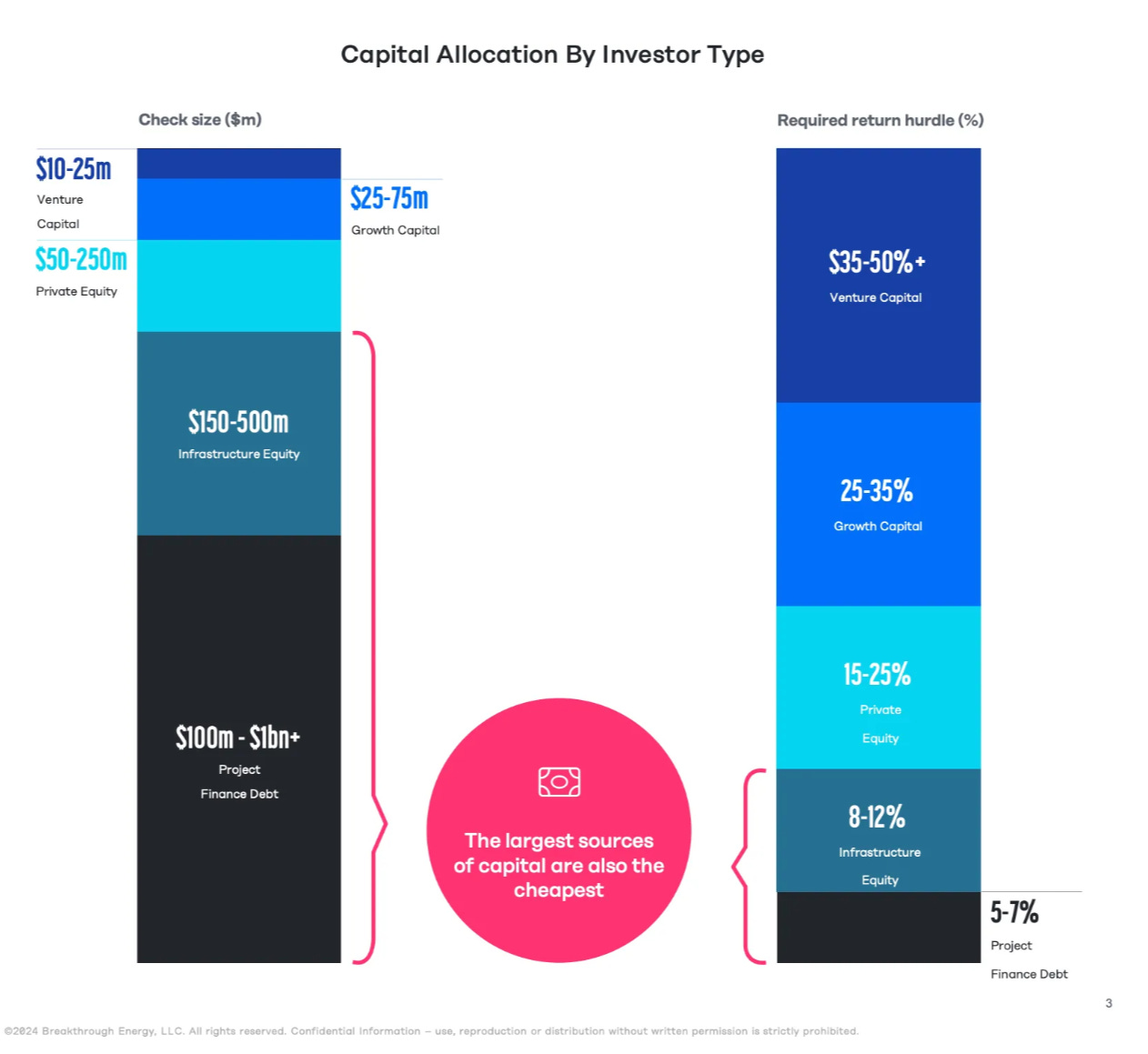

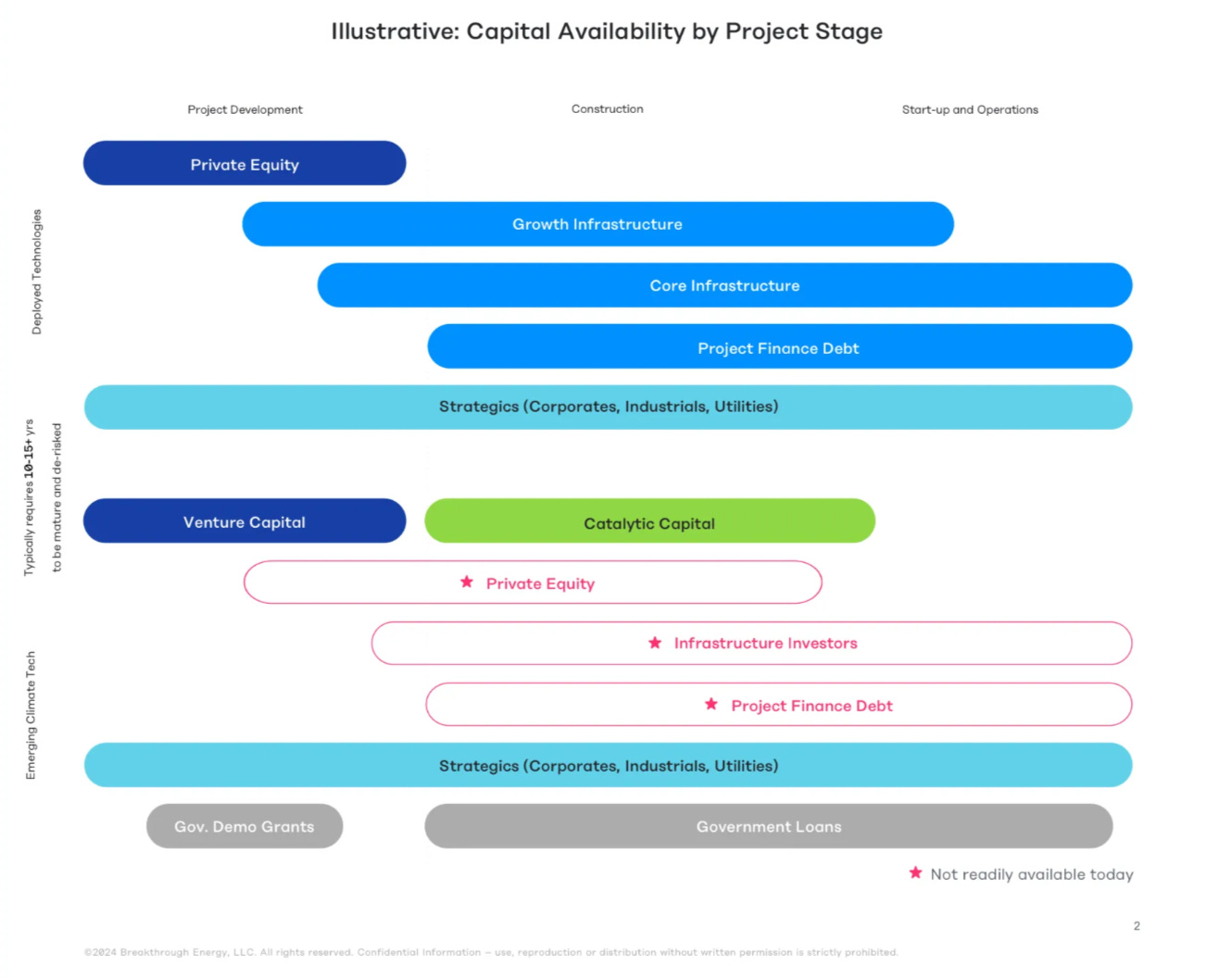

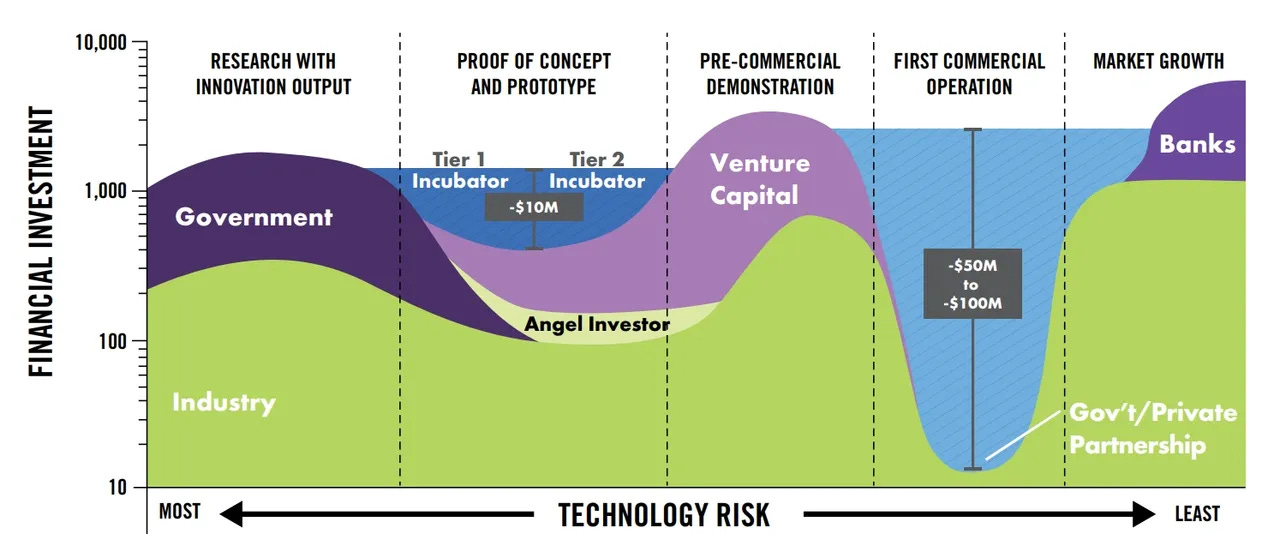

Diverse funding sources are required to advance technologies from the lab to the market, bridging the "valley of death" and addressing various technology and adoption readiness levels. The crux of the challenge lies in how capital is deployed across today's energy transition market. The contrast in risk tolerance between venture capital and infrastructure investors is stark.

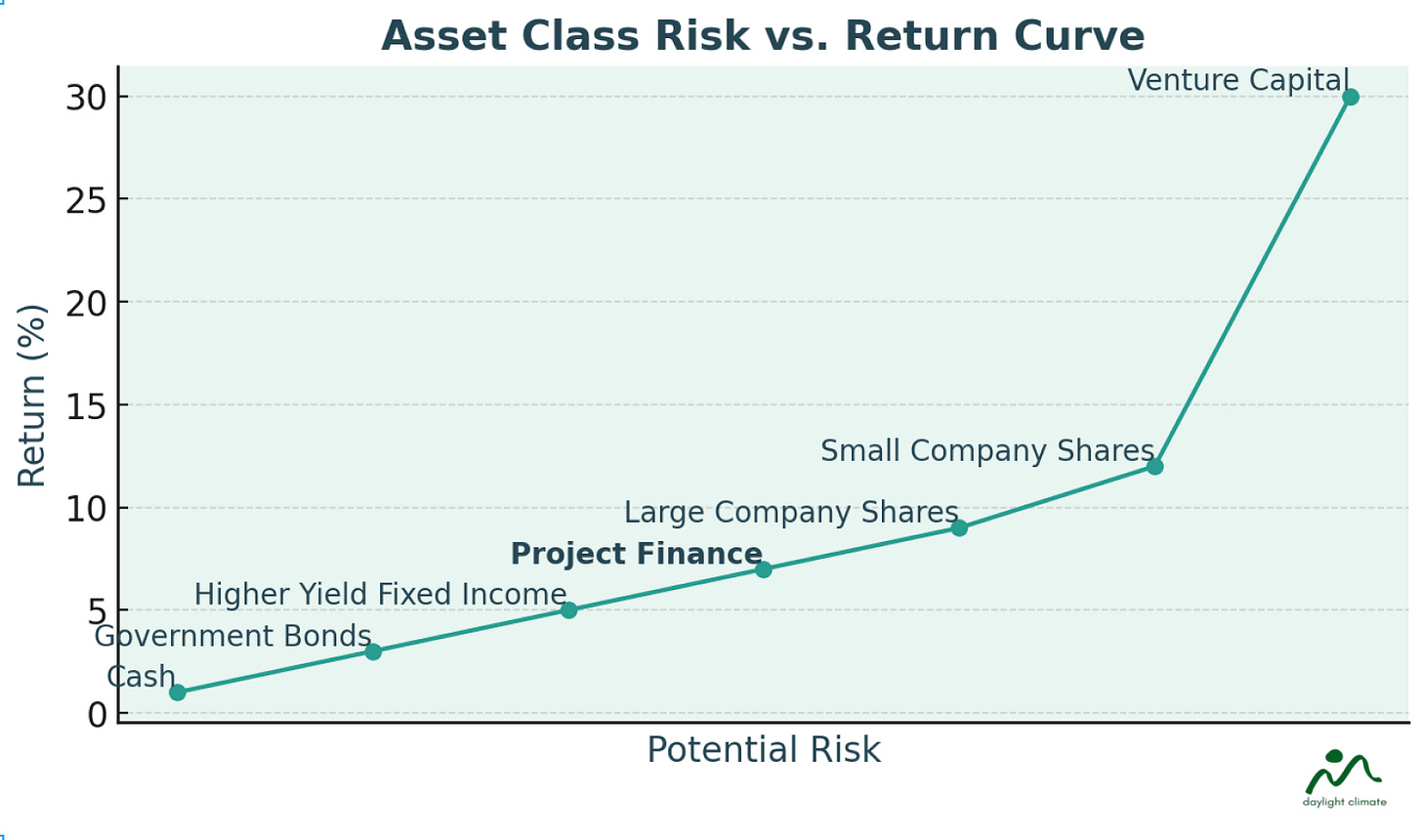

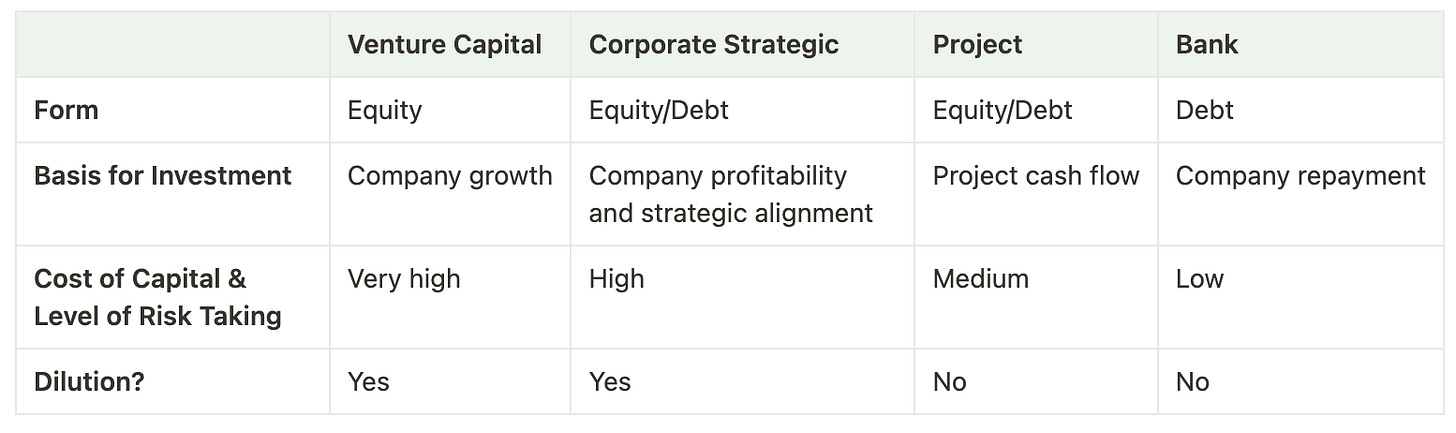

There's a powerful financial tool that makes these projects possible: project finance. This specialized financing approach has been the backbone of infrastructure development for decades, pushing projects forward even when traditional corporate financing isn't feasible. To get to gigaton scale emission reductions, these pools of capital are needed. These capital sources not only provide larger check sizes, but are cheaper in that they require lower returns on investment. The price to pay for capital is lower for these forms of financing.

Why does cost of capital matter?

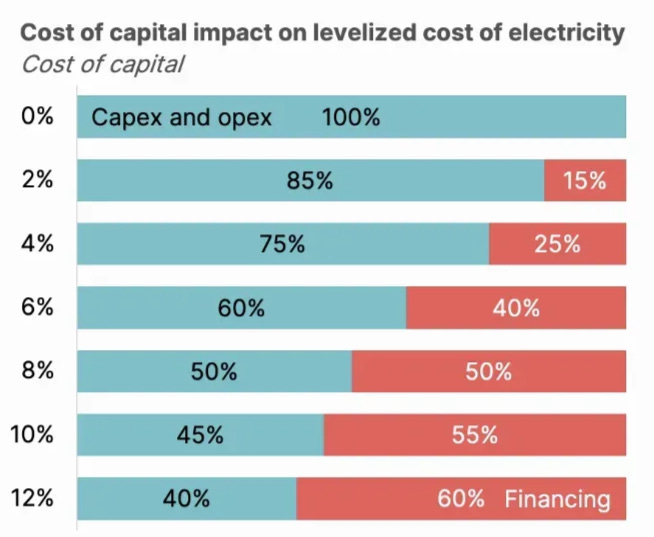

Financing is a huge portion of the Levelized Cost of Electricity (LCOE), or all-in cost per unit of electricity.

breaks this down well in his meaty annual Decarbonization Deck. At an 8% cost of capital, where an investor expects returns of 8%, financing makes up half of the Levelized Cost of Electricity (LCOE).

This reflects an exciting opportunity to reduce the cost of renewables: cheaper cost of capital can catalyze cheaper LCOE. Cheaper capital = Cheaper clean energy = Faster decarbonization.

The difference in cost of capital directly affects whether a project can attract financing and remain economically viable. Clean energy projects often operate in tight-margin markets, and a higher cost of capital can make an impactful project infeasible, hindering progress in renewable energy adoption.

By scaling innovative financing models, we can bring climate tech solutions to market faster and help the world transition to a sustainable future. But what does project finance actually involve? What are financial asset classes? Here is a beginner’s roadmap for our past and future capital stack to accelerate the decarbonization of our economy.

Energy Project Finance 101

If you’re like me and need a bit of a finance 101, let’s start with asset classes. Finance asset classes are categorized by their levels of risk and return. Project finance sits much lower on the risk-turn curve than does risk-tolerant venture capital. This maps to the “required return hurdle” BEC graph above.

Energy project finance is a specialized method of financing for large-scale energy infrastructure projects. This approach involves funding a specific project rather than an entire company, using a combination of equity, debt, and sometimes tax credits. Project finance is a way to raise long-term debt and equity financing for large projects, lending against cash flow generated by the projects. Here are some key concepts:

Project finance is often used for expensive, higher-risk projects: This is because these projects require a large investment (compared to a software company, for example), which requires additional risk management. Projects that often use project finance include developing infrastructure, energy, or natural resource projects.

Cost of capital varies by type: Different types of capital have different costs and return demands. Equity is more expensive for the projectco issuer than investor than debt as it requires giving up a stake in the company. For first-of-a-kind (FOAK) projects, capital costs are particularly high for both debt and equity. Debtholders have first claims over equityholders on remaining cashflows if the SPV defaults, so equityholders are compensated with higher returns.

Non-recourse loans are used to reduce the risk in project finance: Non-recourse loans are a type of loan where the lender is only entitled to repayment from the profits of the project the loan is funding, not from other assets of the borrower. If the project fails to generate enough revenue to repay the loan, the lender cannot pursue the borrower's other assets to recover the debt. This structure is crucial in project finance as it limits the risk for the project sponsors (usually the parent company or investors) to only the amount they've invested in the project.

Non-dilution and scale of capital are two key advantages of project finance: 1) it keeps debt off the parent company's balance sheet and so is non-dilutive, and 2) enables scaling to gigaton levels by accessing large pools of infrastructure capital. The parent company maintains control while accessing capital, since the SPV raises its own debt and equity separately as opposed to selling shares of the parent company.

The value of projects is measured using cashflow based valuation: In project finance, the value of a project is based on the value of output and ability to generate cashflow, rather than on collateral or appraisal of the actual assets.

Risk is allocated across a network of parties: A network of contracts is used to create obligations and line up contract counterparties financially equipped to manage the risk. Strong alignment of equity risk among all partners along the project's value chain is often underappreciated, which can lead to significant cost inflation as the project progresses.

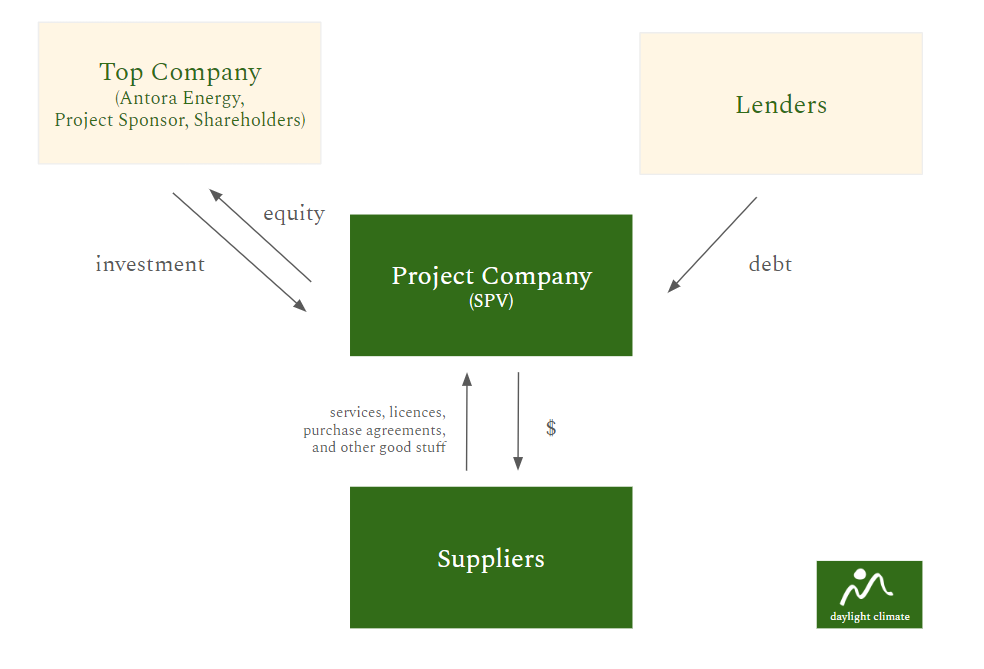

SPV: The Beating Heart of Project Finance

A new project company known as the “special purpose vehicle” or SPV is financially and legally independent from the “Top Company”. The project sponsor is the big energy company looking to do the project, such as a wind developer building a new wind farm or a company like Antora. The established project company has assets, liabilities, and equity on its balance sheet. By setting up a separate entity for the project, the top company’s assets are protected.

The Project Co is the central entity of the four shown in this diagram:

Project Company (SPV) in the center: the legal entity that is established for a project to get financed

Top company (equity providers)

Lenders (debt providers)

Suppliers (who provide the projects with necessary services, goods, etc)

Offtake Agreements: The Lifeblood of Project Finance

If the SPV is the beating heart, the lifeblood of project finance is the offtake agreement. Offtakes and LOIs underpin the feasibility of a project. Little money can be spent on engineering and procurement, and no construction can happen until agreement is in place.

Offtakes are a contract for purchasing a quantity of a commodity (i.e. energy, raw materials, or credits) at agreed terms before production begins. For electricity, offtake agreements take the form of power purchase agreements (PPAs) between the power producer and purchaser. For fuels, offtake agreements are benchmarked against 1-3 year Jet A jet fuel contracts or 20-25 year LNG contracts.

Key components of PPAs include:

Duration: Contracts typically span 10-25 years provide stable, predictable revenue streams that lenders and investors can rely on.

Agreed pricing with adjustments: The agreements set a specific price for the electricity or other commodity being produced, often with provisions for adjustments over time. This helps mitigate market price risks. Pricing can be fixed price, floating price (fixed to market index/benchmark), or hybrid pricing. An example of an adjustment/escalation overtime includes the expected increase in gas cost, which is what the power price is benchmarked upon.

Take-or-pay clauses: Many offtake agreements include "take-or-pay" provisions, which require the buyer to pay for the agreed-upon quantity of energy or product, even if they don't take delivery. This ensures consistent cash flow for the project.

REC clauses: Renewable Attributes (RECs) can be unbundled from the physical energy and sold to a different party, as described in the PPA

Project Finance Key Players and Objectives

Project finance models output Internal Rate of Return (IRR) and Multiple on Invested Capital (MOIC), key metrics for investors to understand the return on an asset

Key entities in project finance ecosystems include:

Lenders, equity investors, tax credit buyers, offtakers, and project developers

Innovative project financiers include Springlane Capital, Breakthrough Catalyst, GreenBack, and Vision Ridge, Builders Vision who are taking new risks for sustainable infrastructure financing. Generate Capital was co-founded by DOE Loan Programs Office (LPO) chief himself, Jigar Shah. Without the DOE LPO, Tesla would not have had the funding to get off the ground.

Tax credit buyers include banks like Bank of America, as well as marketplaces such as Crux, which securitize tax credits from the IRA.

Tax credits play a key role in project finance

The IRA enables projects to be built more cheaply by providing guaranteed tax credit money

Leveraging the IRA's Tax Credit Transferability, developers can now sell tax credits directly, simplifying financing structures (secondary markets for tax credits such as Crux have emerged)

Large companies can incorporate tax credit sales into their financing strategies

RMI has mapped out a number of incentives for climatetech companies from the Inflation Reduction Act here.

Project capital providers for climate tech and sustainable infrastructure projects include:

Specialized infrastructure funds: Include Springlane Capital, Generate Capital, and Vision Ridge, which focus on sustainable infrastructure investments.

Private equity firms: Some PE firms have dedicated clean energy or climate tech divisions that provide project capital.

Institutional investors: Pension funds, insurance companies, family offices, and sovereign wealth funds often allocate capital to large-scale infrastructure projects.

Green banks: Government-backed institutions like the Connecticut Green Bank that provide financing for clean energy projects.

Development finance institutions: Organizations like the International Finance Corporation (IFC) that support sustainable development projects in emerging markets.

Corporate strategic investors: Large companies investing in projects aligned with their sustainability goals or strategic interests.

Specialized project finance firms: Companies like New Energy Risk that focus on structuring and financing innovative energy projects.

These providers often work together in consortiums to finance large-scale climate tech projects, combining their expertise and risk appetites to support the deployment of new technologies and infrastructure. CTVC breaks down the pros and cons of working with each of these funders for FOAK projects.

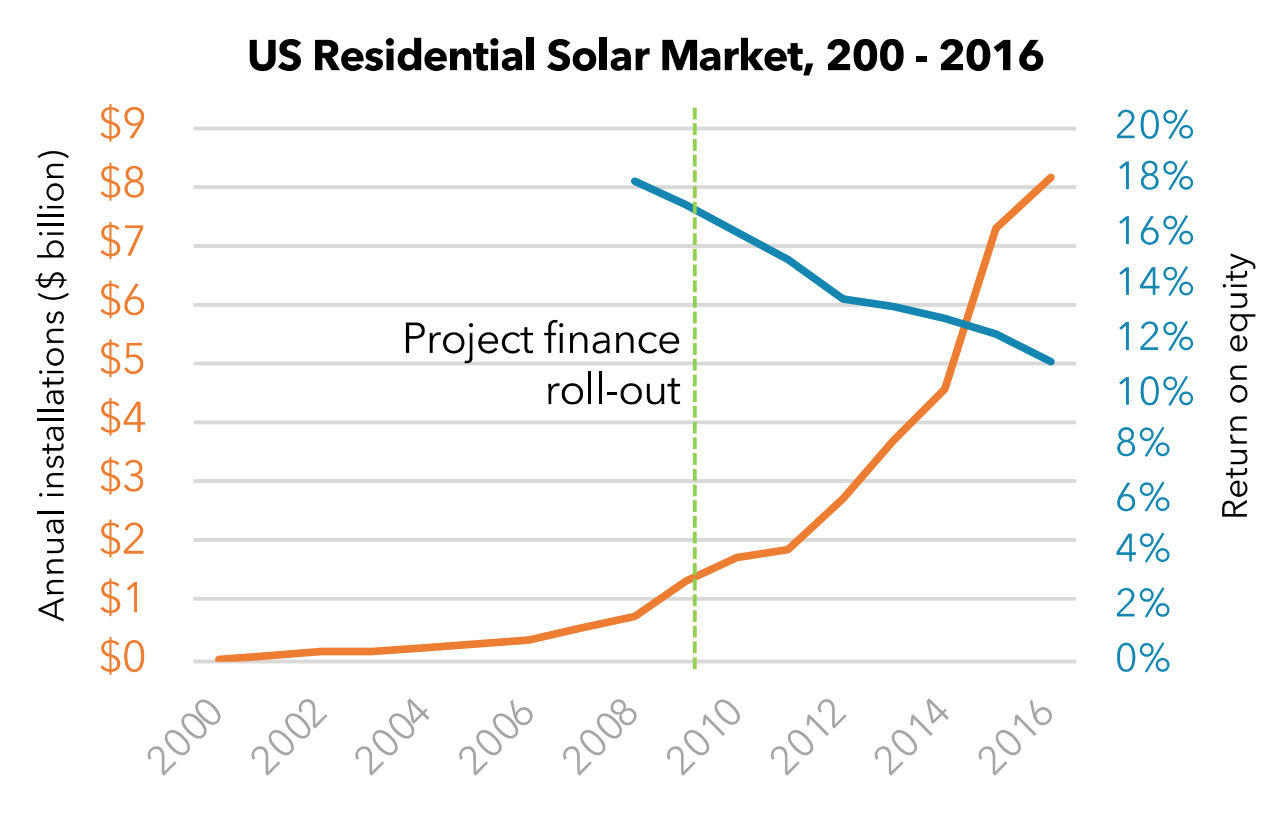

Solar’s Success: A Case Study in Financing Evolutions

The solar industry provides valuable lessons for financing emerging climate technologies.

Initially, solar projects relied on traditional project finance structures, including:

Equity investments from developers and institutional investors

Long-term debt financing from banks

Power Purchase Agreements to secure revenue streams

Tax equity investments for monetizing credits

As the industry matured, innovative financing models emerged, such as solar leases and third-party ownership structures. These new approaches helped accelerate adoption by reducing upfront costs for customers. The solar industry's success in reducing financing costs offers valuable lessons for scaling new clean tech like battery storage. The full history of how solar got cheap is really quite fascinating. This evolution demonstrates how cheaper costs of capital can lead to more affordable clean electricity deployment, a critical factor for achieving widespread adoption. How can we learn from this for capital stack options for new technologies?

The Modern Climate Capital Stack

Emerging Climate Tech will require capital from Private Equity, Infrastructure Investors, and Project Finance Debt that are not readily available today, as shown in the chart below. Emerging Climate Technologies (ECTs) have limited access to funding as they are seen as riskier investments to established technologies.

Here is an overview of the types of capital, timing, and attributes of infrastructure capital provided today. Keep in mind the importance of cost of capital. Venture capital has both the highest level of risk taking, as well as the highest cost of capital. If we use VC to build clean energy projects, paying back investors would be a huge portion of the project and produced energy costs.

Other Keys to Scaling Up by Breakthrough Energy

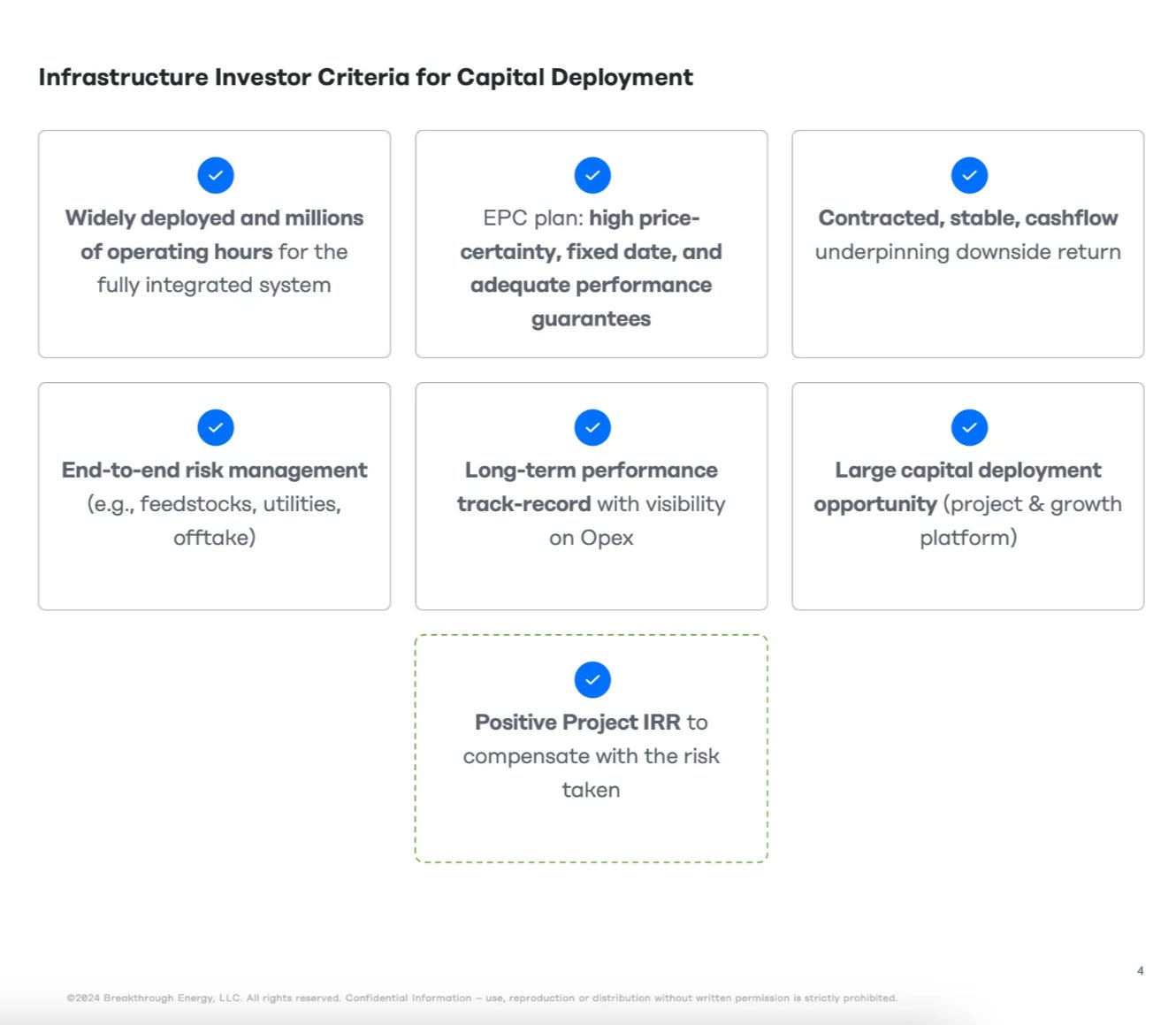

Beyond project finance, there are other key barriers to overcome for large project development. Whether it’s the performance track record, an EPC plan, or end-to-end risk management, infrastructure investors are looking to check off many things before deploying capital.

Pairing project finance with large-scale project development experience is key. From my friend Melissa: “Even in “traditional energy” such as LNG, most large scale projects fail - on the British Columbia coast, only 1 of 11 LNG projects led by Shell/LNG Canada ended up producing product after over a decade of development.” Yes, even with well-established tech and well-resourced companies, projects can fail. Experienced teams can mitigate this risk. Startups that are ready to scale-up can hire project talent in-house or partner with aligned industrials to bring down infra costs. There is much more to say on project development more broadly, so we’ll save that for another time.

Conclusion

The key challenge for our energy transition today is not inventing new solutions, but financing and deploying existing ones at massive scale. While funding emerging climatetech projects is difficult today, an evolving capital stack that meets investors risk appetites will help us get this much needed infrastructure built.

I hope this article helps lay the foundation with core concepts in energy project finance. Key ideas of include the cost of capital, special purpose vehicles (SPVs), and offtake agreements. There is so much more to dig into here! If you’re interested in what structuring offtakes to make new projects financeable entails, leave a note. Accelerating corporate offtakes to derisk financing is an area I’m eager to explore in more depth. I hope by daylighting how climatetech infra funding works today, we can collectively identify gaps and opportunities to streamline funding. I also hope to cover more about how we can bridge the valley of death for funding emerging climatetech.

I’d love to learn what sparked your curiosity or left you feeling confused. Please leave a comment below if there’s anything here you’d want greater depth on. There is so much I am continuing to learn about project finance and the climate capital stack. I will likely share an updated version of this guide and value the input of our community at Daylight Climate! Join our Daylight substack community chat to discuss any questions or ideas. Let’s learn together!

Thank you to Melissa Zhang, David Yeh,

, Andrew Yi, Raghavendra Pai, and others for your valuable insights and feedback that made this article possible. Grateful to be working alongside you all to scale climate solutions!Sources

Breakthrough Energy. Unlocking Capital for Climate Tech Projects: The 12 Keys to Scaling-up.

Builders Vision. Impact Report 2023

Third Way. Energy Finance 101: What is Project Finance?

S2G Ventures. The Missing Middle: Capital Imbalances in the Energy Transition

ER Yescombe. Principles of Project Finance. DOI: http://dx.doi.org/10.1016/B978-0-12-391058-5.00002-3

New Energy Risk. Industrial & Energy Technology Project Finance A Startup and Developer’s Guide to Scaling and Commercial Success.

Climate Drift. FOAK Starter Pack.

Noahpinion. Why I'm so excited about solar energy.

Springlane Capital. Developer U. November 2022.

Springlane Capital. Developer U. June 2024.

Canary Media. Financing first-of-a-kind climate assets.

Tom Rand. The Case for Climate Capitalism: Economic Solutions for a Planet in Crisis. March 2020.

Madison Freeman. Steyer-Taylor Center for Energy Policy and Finance. Guidebook for Early Climate Infrastructure: How Climate Technology Developers are Approaching First-of-a-Kind Projects. April 2024.

Pivotal180. Introduction to Debt and Equity.

Climatetech 360. How to raise project finance.

Appreciate the effort it took to put this primer together. Perhaps it’s outside its intended context, but I’d offer offtaker credit as a key component in the “lifeblood” section. From my time in energy PF, I’m programmed to ask about the top of the waterfall: “where’s the money coming from and who’s paying it?” because of the potential downstream effects on the project’s cost of capital and financing structure.